- NextMetropolis

- Posts

- Iraq's $17 Billion Road, Public Restroom Crisis, Real Estate Tokenization, World's Longest Suspension Bridge Greenlit

Iraq's $17 Billion Road, Public Restroom Crisis, Real Estate Tokenization, World's Longest Suspension Bridge Greenlit

Here's our latest update, spotlighting the top news and trends that are shaping our urban world.

You Should Know

In late July 2025, the U.S. set new electricity peak demand records twice within a 24-hour period, with a high of 759 gigawatts on July 29, driven by extreme heat and demand for cooling.

Electric vehicles currently make up about 50% of new car sales in China, and the country is expected to reach 80% penetration within the next three to five years.

Northern Europe boasts the highest internet penetration rate in the world at 97.7%, while East Africa has the lowest at 23.5%.

Worth Watching

Life-like robots for sell in China’s first robot mall.

An insider's look at Virginia’s $4 billion tunneling megaproject.

Bhutan’s Planned Gelephu Mindfulness City is the Anti-Dubai.

Top Stories

Iraq’s $17 Billion “Road” to Connect Asia and Europe

Iraq is aiming to position itself as a vital gateway between Asia and Europe by advancing its ambitious Development Road Project. Despite its generic name, the scale of the project is extraordinary. Stretching over 1,200 kilometers (about 750 miles), the corridor will integrate railways, highways, ports, and cities, significantly cutting travel times between the two continents.

First unveiled in 2023, the “Iraqi Silk Road” has drawn interest as an alternative to the Suez Canal for trade between Asia and Europe. In April 2024, Iraq, Turkey, Qatar, and the UAE signed a quadrilateral memorandum of understanding to cooperate on the project.

Iraq’s Ministry of Transport estimates the cost at around $17 billion. Funding is expected from Gulf partners such as Qatar and the UAE, with additional international investment targeted during the next phase. The Ministry reports that 60% of the project’s strategic designs and maps are complete, with the first phase of construction expected to begin before the end of 2025. Completion will be phased, with milestones set for 2028, 2033, and 2050.

At the heart of the project is a high-speed rail network designed to reach speeds of up to 300 km/h. Spanning the length of the corridor, the rail system will feature about 15 strategically placed stations to enhance regional connectivity. It will serve both freight and passenger traffic, reducing transportation costs and increasing efficiency across Iraq and neighboring regions.

Iraq has also activated the United Nations’ TIR customs transit system, which harmonizes customs procedures and allows freight traveling along the Development Road to cross borders with minimal delays.

The Grand Faw Port, located at the southern terminus of the corridor, is set to become the largest port in the Middle East. Once fully developed, it will feature up to 100 berths and a 14.5-kilometer breakwater—the longest in the world.

Beyond transportation, the Development Road is positioned as a strategy for economic diversification, reducing Iraq’s reliance on oil by leveraging its geographic location. The corridor is projected to generate $4 billion annually and create at least 100,000 jobs.

Flush with Ideas: Cities Take on Public Restroom Shortages

Cities worldwide are facing a growing challenge: a severe shortage of public toilets. According to the Public Toilet Index by QS Supplies, the United States has just eight public toilets per 100,000 people—well below the global average.

In many North American and European cities, public restrooms are closing due to budget cuts. In New York City, only about 1,100 restrooms serve over 8 million residents, with many locked overnight, leaving locals and tourists scrambling for alternatives. In India, 12% of households lack access to a toilet, underscoring the scale of the sanitation crisis in rapidly urbanizing areas. This shortage not only inconveniences the public but also worsens public health concerns, particularly in cities with growing homeless populations. Here are some innovative solutions cities are adopting to address the public toilet crisis:

Cities like Washington D.C., Los Angeles, and Ann Arbor have partnered with Throne Labs to improve public restroom access. Throne Labs provides mobile, off-grid portable toilets that use sensors to monitor cleanliness, alert maintenance teams, and allow access via mobile app or QR code.

London operates the Community Toilet Scheme, partnering with local businesses to provide free public access to their restrooms. Cafés and restaurants allow anyone to use their toilets without requiring a purchase, and in return, receive annual payments of £500 to £1,200 from local councils for maintenance.

France is rolling out MadamePee, offering mobile, water-free, no-contact urinals designed for women. Deployed at public events and in urban spaces, they reduce wait times and promote inclusivity.

Numerous cities are now integrating restroom locations into a Google Maps layer, allowing people to easily locate nearby facilities. See this one offered by New York City.

India’s LooCafé converts shipping containers into café-and-toilet units. Café revenue funds upkeep, while IoT monitoring ensures cleanliness across 350+ units in multiple states.

Real Estate Tokenization: High Hopes, Steep Climb

Real estate tokenization refers to converting ownership rights in physical properties into digital tokens on a blockchain. Each token represents a fractional share in the real estate asset, offering investors a chance to buy, sell, or trade slices of property with greater ease.

Forecasts project enormous promise: Deloitte estimates the tokenized real estate market could swell from under $300 billion in 2024 to about $4 trillion by 2035.

Several projects have launched in the space. In the U.S., Lofty has tokenized over 180 residential properties, with tokens priced as low as $50. In Detroit, RealT owns roughly 800 properties and 1,200 housing units. In 2018, Elevated Returns issued 18 million Ethereum-based tokens representing 19% ownership of the Aspen St. Regis Resort.

The Middle East is positioning itself as a hub for digital real estate innovation. Saudi Arabia's Rafal Real Estate partnered with droppRWA, allowing investors to acquire fractional ownership of properties with investments starting from one Saudi riyal. In early 2025, developer DAMAC signed a $1 billion deal with blockchain platform MANTRA to tokenize assets in the region. Prypco Mint started offering fractional ownership of Dubai properties via tokenization, with shares starting at $550 and backed by a certificate from the Dubai Land Department.

Yet despite progress, adoption remains slow. Regulatory uncertainty is a major hurdle, with many jurisdictions lacking clear rules for tokenized securities—particularly for cross-border transactions. Technical fragmentation is another challenge, as blockchain platforms often operate in silos without a dominant interoperability standard. Institutional-grade custody and management solutions are still maturing, leaving investors cautious. Finally, secondary market activity is often limited, meaning liquidity often falls short of expectations.

Some deals have faltered. RealT faces a City of Detroit lawsuit for allegedly neglecting properties and misleading investors, including 39 homes sold for $2.7M without closing (the deeds remain with the seller). The city seeks to compel repairs, update filings, and enforce housing compliance on 400 properties. Elevated Returns’ Aspen tokenization, though groundbreaking, remains confined to accredited investors and hasn’t triggered retail adoption.

Real estate tokenization has transformative potential, but mainstream adoption requires overcoming key legal, technical, and execution hurdles.

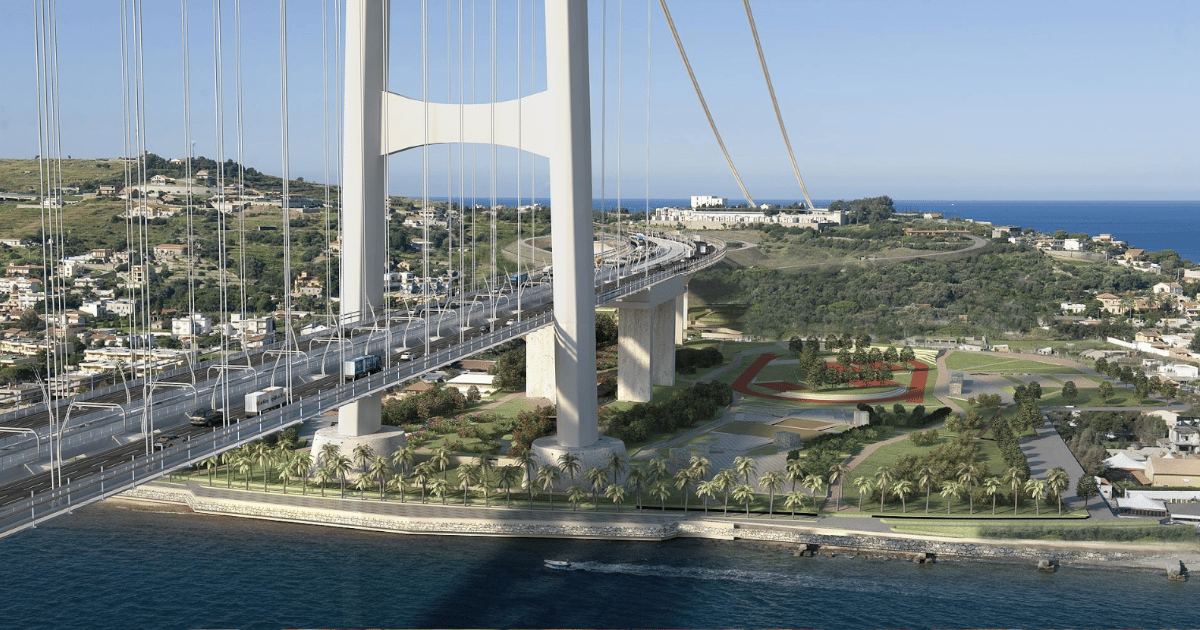

Italy Greenlights World’s Longest Suspension Bridge

Italy has approved plans to build the world’s longest single-span suspension bridge, connecting Sicily to the mainland across the Strait of Messina. Spanning 3.3 kilometers (2.05 miles) with a total length of 3.7 kilometers, the €13.5 billion ($15.5 billion) project will surpass Turkey’s 1915 Çanakkale Bridge as the longest of its kind.

First proposed in the late 1960s and repeatedly shelved over cost, environmental, and seismic concerns, the bridge was revived in 2023. Construction is slated to begin in 2026 and finish by 2032–33, pending final audit approval.

The design calls for two 399-meter-tall steel towers supporting a 60-meter-wide deck with three vehicle lanes and two rail tracks in each direction. The capacity: 6,000 cars per hour and 200 trains daily—cutting ferry crossing times from over 90 minutes to 10 minutes by car.

Supporters, led by Transport Minister Matteo Salvini, call it “the biggest infrastructure project in the West,” forecasting up to 120,000 jobs annually and billions in complementary investments in roads, railways, and urban renewal. The government also argues the bridge has strategic military value, forming a rapid-deployment corridor for NATO forces.

Engineers stress that the site’s seismic risk can be managed with advanced materials such as fiber-reinforced polymers, seismic-absorbing expansion joints, and wind-resistant designs tested to withstand gusts of 181 mph. Environmental safeguards include reforestation and protections for nearby rivers.

Still, opposition remains fierce. The “No Ponte” movement argues funds should go to existing infrastructure and warns of environmental disruption, mafia infiltration, and harm to migratory bird routes. Protests in Messina this month drew an estimated 10,000 participants.

If completed, the bridge will stand as an engineering landmark—and a symbol of Italy’s decades-long struggle to unite vision with execution.

Big Deals

Meta taps PIMCO, Blue Owl for $29 billion financing of data center expansion project.

Harbor Group International acquires New England multifamily portfolio for $740 million.

Joby Aviation acquires Blade Air Mobility's rideshare business for as much as $125 million.

Bain Capital and 11North Partners buy $212 million portfolio of open-air retail centers.

Brixmor acquires Houston retail-office complex for $223 million.

Apollo Funds buys majority stake in Stream Data Centers.

Western Midstream acquires Aris Water Solutions for $1.5 billion.

Extra Reads

What is driving Brazil's $55 billion infrastructure boom?

American malls are less Macy’s, more church, bowling, Barnes & Noble.

US regulators approve Zoox's driverless car without steering wheel or pedals.

Syria signs $14 billion in infrastructure deals to revive economy.

Meta will buy all the renewable energy from Enbridge's $900 million Clear Fork solar project.

Apple announces $100 billion investment in U.S. manufacturing expansion.

Nigeria launches 90,000 km fiber optic network for national connectivity.

Lyft partners with Baidu to launch robotaxi services in Europe.

Millions in mobile home parks lack access to safe drinking water.

The African Development Bank leads $7.8 billion project for Africa's largest airport.

Denver eliminates parking minimums to encourage new housing development.

Massive 502-foot turbine blades aim to power 40,000 homes.